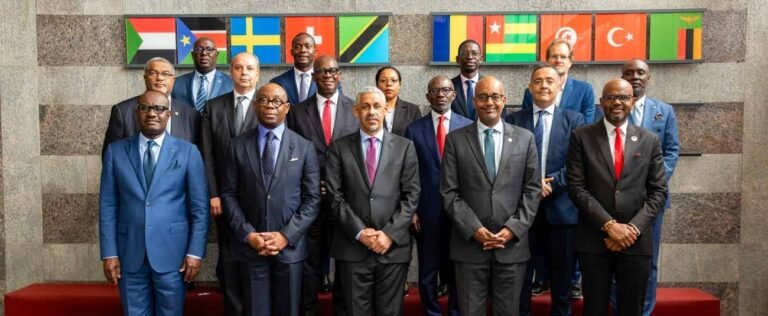

The African Development Bank Group has begun laying the foundations for a continent-wide financial coordination platform aimed at addressing one of the most persistent obstacles to Africa’s development: the fragmentation of its financial institutions and the chronic lack of long-term capital to reach innovative projects. The proposal gained momentum in Abidjan on November 19, when the Bank’s Governor, Dr. Sidi Ould Tarr, convened a series of working sessions with leaders of regional development banks, private partners, and stock exchanges to signal a move towards a more unified African financial architecture.

Discussions centered on common realities. African governments face increasing demands for financing as domestic revenues remain constrained and global capital markets soar.

Also read: EU proposed review of SFDR aims to reduce greenwashing and pave the way to streamline investments in Africa

As many countries face deteriorating credit ratings, rising debt service obligations and shocks from climate change, institutions such as the African Development Bank Group, the West African Development Bank, the African Finance Corporation, the Eastern and Southern African Trade and Development Bank, and Shelter Afrik are under increasing pressure to deliver more with their limited balance sheets.

The conference sought to answer practical questions about how Africa’s leading financial institutions can align their pipelines, standards and instruments in ways that reduce duplication and enable greater affordable capital flows.

Dr. Urd Tarr told the assembled leaders that a new platform was needed because the continent’s resource needs exceeded existing arrangements. The World Bank estimates that Africa needs more than US$200 billion a year to meet its core development and infrastructure needs, a figure raised significantly by separate climate assessments.

In this regard, he asserted that DFIs in Africa are of strategic importance. This is because African DFIs are close to the ground, understand the intricacies of local regulations, and often serve as the first financier for infrastructure and housing projects that commercial banks consider too risky.

Participants emphasized that Africa’s development finance system is strong in intent but broken in implementation. Overlapping mandates, disparate project pipelines, and mismatched technical standards often delay implementation or force projects into parallel structures.

Executives at the meeting pushed for harmonized rules and shared project preparation facilities to reduce cost overruns and prevent delays that undermine investor confidence. They argued that a shared platform would make it easier for agencies to co-finance projects, pool risk and deliver everything from regional transportation networks to affordable housing programs.

The conversation repeatedly turned to the issue of liquidity. Adomas Tadesse, Eastern and Southern Africa Trade and Development Bank, stressed that regional institutions often face liquidity shortages, increasing the cost of capital. He suggested a continent-wide standby facility backed by the African Development Bank’s AAA balance sheet, which could stabilize regional DFIs during times of market instability. He said that without such mechanisms, African financial institutions would remain vulnerable to external shocks and would struggle to scale up lending to the required levels.

Also read: AfDB approves USD 100 million loan to strengthen Africa’s infrastructure and clean energy pipelines

Executives also pointed to the growing link between political risk and funding constraints. Serge Ekuet of the West African Development Bank noted that the recent wave of coups in West Africa has transformed the region’s credit landscape. He acknowledged that his institution avoided a rating downgrade by maintaining strong equity buffers, but regional shocks continue to distort capital flows and limit long-term borrowing capacity. For this reason, he said cooperation with large institutions such as the African Development Bank Group is essential to maintain stability in the region’s financing system.

Other leaders echoed the theme of collective strength. Dr. George Agikum Donkor of the ECOWAS Investment and Development Bank argued that syndicates, co-financing arrangements and joint due diligence with stronger partners could leverage credibility that smaller regional DFIs cannot build on their own. On behalf of the African Finance Corporation, Sameh Shenouda highlighted the continent’s lack of bankable projects and capital resources, noting that Africa’s ability to raise long-term finance will continue to be constrained until institutions collaborate deeply on project development, early-stage risk mitigation and common communication strategies in global forums.

The housing sector was also highlighted as an area where better coordination could quickly change outcomes. Tierno Habib Khan, CEO of Shelter Afrik, explained that piecemeal efforts often slow down the affordable housing pipeline and argued that joint project preparation and shared technical teams can help deliver large-scale housing programs that meet demographic pressures in cities from Dakar to Kampala.

African Development Bank Vice President Solomon Quayner listened to the deliberations and expressed commitment to system-level reform. He emphasized that cooperation extends beyond the Bank to the network of participating DFIs themselves, and bilateral follow-up is planned to design new capital allocation approaches. The task force will now work to strengthen the capital base of DFIs, improve de-risking mechanisms, develop concessional lending tools, and create liquidity structures that can support regional institutions through market disruptions.

Related article: UNEP and CCAC release first global methane report, charting path to 2030 reduction targets

Dr. Ould Tarr concluded the meeting on a positive note, noting that the consultations had revealed both gaps and opportunities that could shape Africa’s new financial ecosystem. He announced that the Bank will move the next stage of discussions to London in mid-December, and will meet with private investors and credit rating agencies immediately after the final meeting of the African Development Fund’s 17th replenishment. This will be a key moment, as the strength of ADF-17 will influence how much concessional financing is available to African governments in the coming years.

The new coordination platform reflects the recognition that African institutions cannot afford to compete in silos. The scale of Africa’s development and climate change needs is too large for piecemeal efforts, and the capital costs are too high for overlapping pipelines. The work launched in Abidjan could determine whether Africa’s financial sector becomes a more integrated engine for development or continues to function as a collection of powerful institutions operating in isolation.

Connect with us on LinkedIn: Sustainability in Africa matters