The path from concept to capital

In our previous article, we looked at how infrastructure tokenization can address the perennial challenge of liquidity. We considered the structural hurdles in traditional infrastructure investing and how blockchain may offer a new path forward, particularly in unlocking capital from a broader and more diverse investor base. Now we move from principles to practice.

To move tokenization from theory to reliable investment mechanism, it must first pass through the familiar territory of financial instruments supporting the flow of capital. In this article, we begin to identify two pathways: the use of tokenized bonds that provide indirect exposure to infrastructure assets, and the direct tokenization of those assets themselves.

There are opportunities with both approaches. But they also raise important questions about structure, regulation, and implementation.

Rethinking infrastructure bonds

Bonds have long been the mainstay of infrastructure finance. Trusted for predictability and valued for alignment with long-term goals. But traditional bonds come with problems. These tie up capital for years and once issued, there is little room for maneuver. A door will open here.

Tokenization introduces a new class of infrastructure bonds. These are not just digital versions of things that already exist. These are intelligent, programmable assets that represent claims on future cash flows. More importantly, it allows you to segment your investments, making them accessible to a wider range of investors. From sovereign wealth funds and development banks to individual investors and diaspora communities, the gates are opening. Regulated platforms and compliant digital marketplaces have enabled participation in ways that were once out of reach.

The bond itself becomes dynamic. These blockchain-powered devices will gain new capabilities. Coupon payments are automated. Compliance is built into the code. All transactions are recorded in real time and visible to all parties. The result is a structure that moves with precision. It’s faster, more efficient, and completely transparent.

This is no longer a distant concept. Traditional finance is already starting to move. EIX Global is working with Aquis Exchange to deploy private placement debt to finance infrastructure projects through a functioning secondary market. The repayment guarantees and institutional structures they use show that the market is evolving. But tokenized bonds are more than just an evolution. They have been redesigned from the ground up.

They eliminate friction. No need to make manual adjustments. We do not rely on custodians or clearing services. Smart contracts allow issuance, trading, and settlement to occur on a single, seamless digital track. What once took days can now be done instantly because trust is encoded and done automatically.

Tokenized bonds are also applicable. Coupon rates can correspond to sustainability milestones and project benchmarks. Transfers can be restricted to verified investors in real-time based on embedded compliance logic. they open the door. Not just for sovereign players, but also for everyday investors, regional coffers and purpose-driven capital. With live reporting and transparent audit trails, trust isn’t built by paperwork. This is built into the blockchain protocol.

We are already seeing this momentum take shape. Platforms like OpenEden are carving out a space for tokenized real-world assets with the launch of MOODY-rated investment-grade treasury funds. Their model reflects the efficiency, accessibility, and streamlined user experience enabled by tokenization. Financial products themselves will begin to evolve. What appears is not an upgrade. It’s a new language. Something that speaks in executable code rather than static agreements. One that prioritizes access over exclusivity. It brings infrastructure closer to people.

This is more than just the cornerstone of financial architecture. This is the first step in rethinking how we fund the physical world.

Tokenization of the asset itself

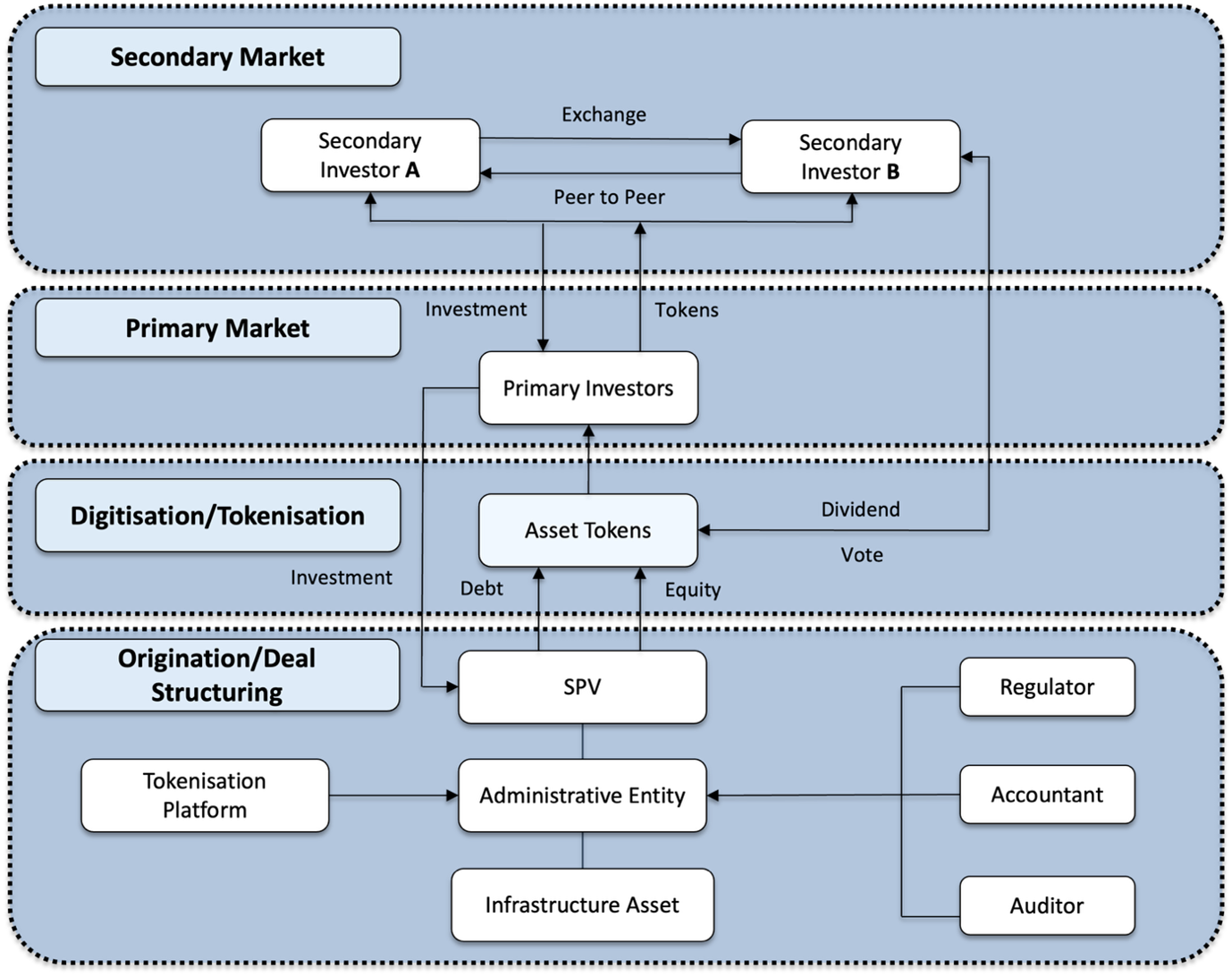

While bonds provide indirect exposure, direct tokenization requires a more fundamental step: dividing ownership of an infrastructure asset into digital tokens that can be bought and sold. This approach brings the infrastructure into the realm of asset-backed securities, with token holders potentially earning rights to revenue, governance, and even a portion of the future value of their shares.

What once required deep funding and access to institutions is now opened up through compliant peer-to-peer digital platforms. In fact, the infrastructure will begin to behave like a public market instrument, with all the associated transparency, traceability, and accessibility that blockchain provides.

However, this route also presents new challenges. Who controls the platform? What rights do token holders have? And how can such investments be structured in a way that reconciles public value and private capital?

Secondary market and liquidity issues

Whether via bonds or direct asset tokens, important tests remain. The question is whether true liquidity can be achieved.

The secondary market is a mechanism that maintains the liquidity of capital. Without these, tokenization risks becoming just another layer of complexity. These can be used as tools for dynamic participation, allowing investors to enter and exit positions more freely, making price discovery transparent and allowing projects to remain attractive over time.

This is more than just creating an app to buy and sell tokens. It’s about building regulatory clarity, trusted custody, and interoperability between digital asset platforms and traditional finance. Once the secondary market becomes stable and reliable, capital will follow.

Looking to the future: From innovation to integration

The financial mechanisms described here are not futuristic abstractions. These are based on established principles of project finance and capital markets, simply reimagined through the lens of new technology.

The challenge ahead lies in integration. Scaling tokenization requires coordination between developers, regulators, investors, and technologists. We need bold first movers willing to pilot real infrastructure projects using sandboxes, testbeds, and tokenized models.

Africa stands at a unique crossroads, with its young demographic, digital orientation, and infrastructure needs. The opportunity to leapfrog legacy systems is real. But doing so requires not only the tools, but also the trust, talent, and tenacity to see it through to the end.

In our next article, we will draw on recent case studies, regulatory trials, and lessons from adjacent sectors to begin planning how such financial structures can be designed in practice. Because the question is no longer whether you can tokenize your infrastructure, but how and how quickly you can tokenize it.

Top photo: Smart City Digital Network (Setansel/Dreamstime)