Logistics and supply chain constraints could create barriers to investment in Africa’s construction market, says a new report from UK-based consultancy Turner & Townsend.

According to the Global Construction Market Intelligence (GCMI) 2025 report released in early July, historic underinvestment in logistics networks and a limited number of top contractors able to take on larger programs could impact the continent’s positive growth trajectory.

Africa, particularly in East Africa, is experiencing rapid population growth, increased spending on renewable energy, and significant investment in modernization and urbanization. This, combined with low construction costs, offers attractive prospects for investment and generates strong optimism in many areas, the report said.

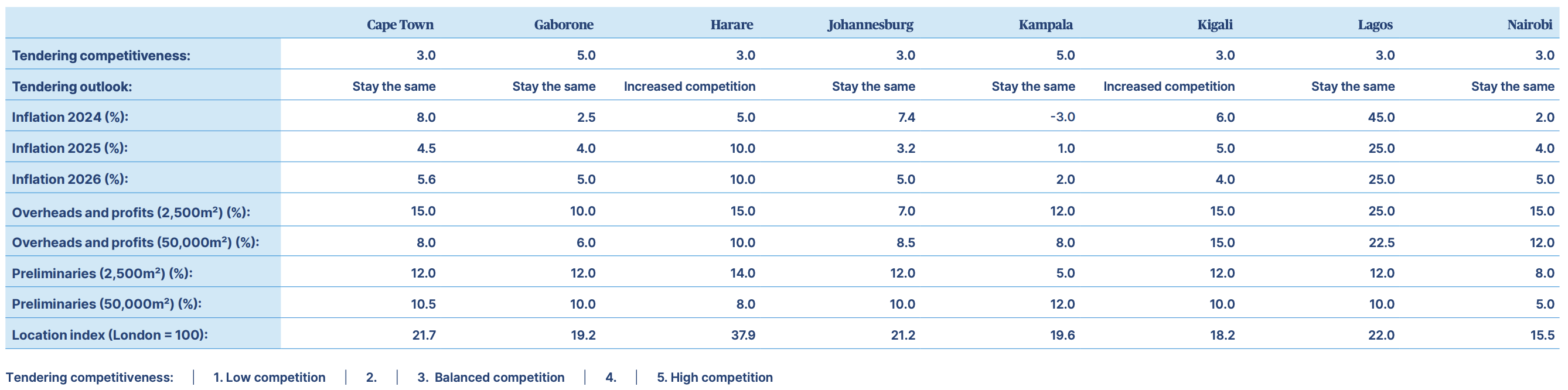

Good availability of labor and access to materials has kept construction costs low across Africa, averaging just US$1,188 per square meter, and inflation has been manageable in the low single digits in most regions. The short-term impact of recent global trade negotiations has been relatively modest and stable in most regions, as the economy is not closely tied to the United States, although local currency fluctuations have affected construction costs in dollar terms, such as the 45% inflation rate in Lagos, Nigeria, in 2024.

The challenge for stakeholders, therefore, is not so much about cost as it is about labor and logistics choices, ensuring that skills and materials go where they are needed, the GCMI report says.

The region has often seen relatively strong competition for jobs, but now there is a significant labor shortage. Particularly in South Africa, there is a risk that bid price competition will be reduced due to the limited number of first-class contractors able to take on larger programs. High unemployment rates may lead to more local retraining and upskilling to fill market gaps, but this is not yet common.

The report says that to prevent program impacts, customers need to take a more active role in filling gaps, by investing directly in training local skills and bringing in international expertise where appropriate.

Source: Turner & Townsend

“There are many signs of optimism across Africa, with increasing opportunities to drive investments that support economic diversification,” said Wendy Cerruti, director and regional real estate head for Africa at Turner & Townsend.

“Not only are population growth driving urbanization and infrastructure development in many regions, but there is also a strong focus on high-tech industries, from advanced manufacturing to data centers, and significant government spending on renewable energy.

“Growth comes with supply chain challenges, which means labor and logistics will be a top priority for our clients. There are currently critical shortages in top-notch contractors and specialized skills, and clients need to proactively manage these by increasing ownership of their construction infrastructure and building the necessary skills directly, either locally or through imported labor. To do this successfully, clients will need to think programmatically to de-risk their projects.”

Source: Turner & Townsend

The African Continental Free Trade Area (AfCFTA), which came into force in 2021 and mandated the creation of a single continental market, could help resolve these issues. The AfCFTA is projected to increase intra-African trade by 40% by 2045, and has the potential to increase investment, cross-border contracting, construction opportunities and the mobility of skilled labor, said Segun Faniran, founder and publisher of ConstructAfrica.

In terms of investment, the AfCFTA single market for construction goods and services across the continent will widen the investment opportunities available in this sector for African countries, making them attractive to foreign investors. A single unified market will also attract foreign investors seeking opportunities in a stable and predictable environment. This will increase capital inflows into construction projects across the continent and ultimately spur infrastructure development.

Regarding cross-border contracts, the AfCFTA’s creation of a continental market of over 1.3 billion people will increase demand for construction services and materials. The presence of more players in the market across the continent will lead to innovation and higher quality services at competitive prices. Additionally, joint projects can be launched across borders with funding from multiple countries and financial institutions, leading to infrastructure improvements.

Strengthening cross-border collaboration between governments and the private sector will foster more public-private partnerships (PPPs) and provide access to a broader pool of vital funding and expertise.

By increasing the mobility of skilled workers, the AfCFTA could help address labor shortages in different regions and enable the transfer of expertise and best practices. Professionals can also network across borders and foster partnerships and collaboration on construction projects. Additionally, increased mobility can lead to more integrated training programs and strengthen skills and competencies within the workforce.

costs and trends

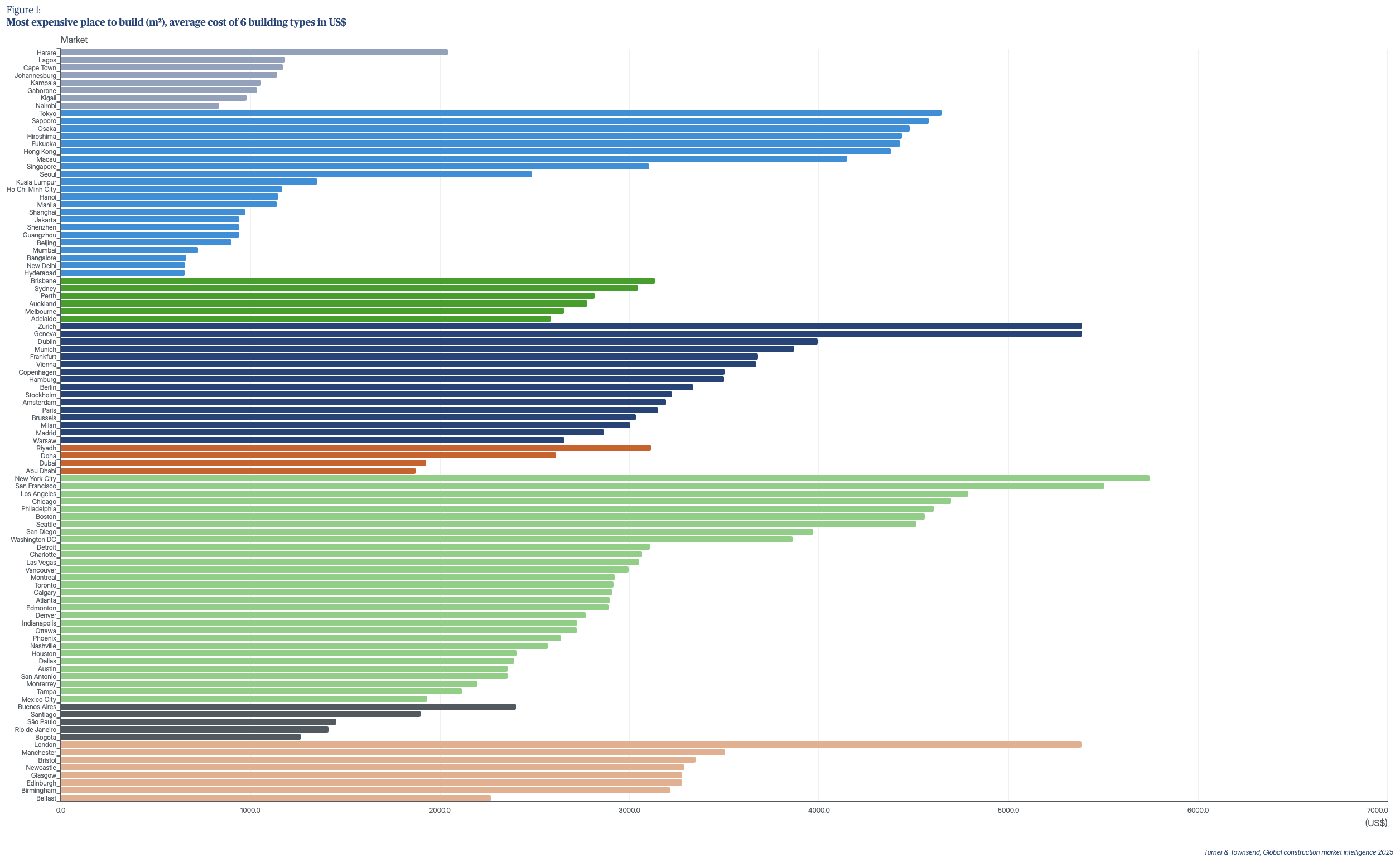

Turner & Townsend’s GCMI report, which also analyzed construction costs and trends across the continent, named Harare, Zimbabwe as the most expensive African construction market at US$2,042 per square meter, US$800 more than second place Lagos (US$1,183 per square meter). Nevertheless, Zimbabwe has invested in diverse markets in recent years, from tourism and leisure to infrastructure, and is expected to continue on a growth trajectory.

Meanwhile, Rwanda remains Africa’s second cheapest construction market, at US$979 per square meter, supported by the government’s modernization and urbanization drive, including a focus on affordable housing and infrastructure.

Access to sustainable and resilient electricity is a top priority for markets around the world, and Africa is a region in a strong position, the GCMI report said. In East Africa, government spending on renewable energy and grid resilience is helping to keep power costs down, attracting investment in energy-intensive sectors such as data centers and advanced manufacturing. Capital costs average US$834 per square meter in Kenya, and the availability of this power, coupled with a stable currency and low import duties, is attracting investment, the report said.

South Africa has traditionally been one of Africa’s strongest construction markets and is benefiting from an overall economic recovery and government of national unity, but inflation due to rising fuel prices remains a concern, the GCMI report said. Public and private investment in mixed-use revitalization, education, housing and energy, and power infrastructure are creating opportunities, but data shows the market is uneven across the country’s major cities.

Costs in Cape Town average US$1,231 per square meter, rising at a rate of 9% until 2025. In comparison, construction cost inflation is expected to fall from 7.4% in 2024 to 3.2% this year in Johannesburg as competition for jobs increases.

Globally, two U.S. cities rank at the top of the GCMI rankings. New York remains the most expensive construction market at US$5,744 per square meter, followed by San Francisco in second place at US$5,504 per square meter. Zurich, Switzerland, ranked in the top three with USD 5,386.4 per square meter.

Source: Turner & Townsend

Top photo: Construction (© 2day929 | Dreamstime.com)