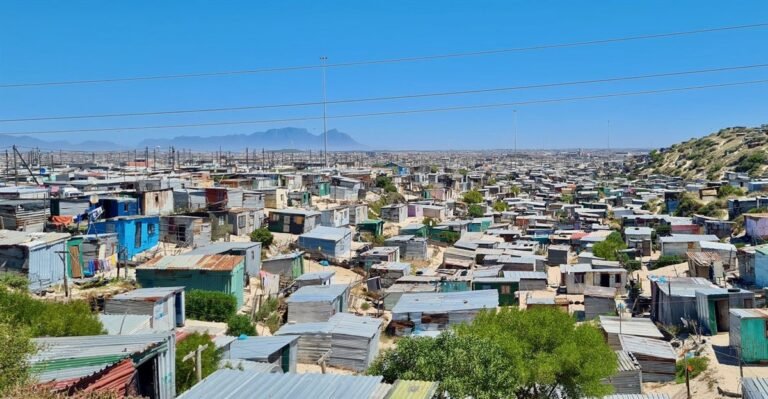

Partial Credit Guarantees (PCGs) provided by Shared Interest help local developers in Cape Town finance and build dignified housing in low- and moderate-income communities, overcoming long-standing credit barriers.

Recently, Shared Interest hosted a roundtable and guided site visit to affordable housing projects in Khayelitsha and Mandalay financed through guaranteed loans, demonstrating how guarantees unlock capital for small and medium-sized enterprises (SMEs) and foster inclusive urban development in areas where traditional mortgage financing is largely unavailable.

“Affordable housing is a pressing need and we have talented developers ready to deliver. What they lack is capital,” says Lusanda Neshtenze, chief executive officer of TUHF21, an organization that finances affordable housing developers across South Africa.

“PCG allows us to say yes more often. We can confidently lend to entrepreneurs who are building real value in their communities.”

Reduce risk with a credit guarantee model

Shared Interest’s credit guarantee model reduces risk for microfinance institutions, banks and development financiers by covering a portion of potential losses.

This allows us to provide funding to early-stage and underserved entrepreneurs who may lack collateral, long-term track records, and traditional financial profiles, especially in the housing sector where impact and affordability are paramount.

“In Cape Town, we partnered with Reed Capital to guarantee affordable financing for BitProp, which is targeting women homeowners and turning them into landlords.

“Through our partnership, BitProp has built and managed 72 homes for 12 women, increasing real estate value and revenue.

“We are in talks with TUHF to replicate this successful pilot with Reed in Johannesburg,” says Anne McMikel, Executive Director of Shared Interests.

Warranty impact

Shared Interest’s partial credit guarantee issued $34 million in guarantees and enabled $132 million in small business loans, reaching more than 2.3 million beneficiaries, 60% of whom are women and youth.

The goal for 2025 is to deploy $8 million to $11 million in guarantees to support high-impact sectors such as housing, agriculture, fintech and climate resilience.

Expanding financial inclusion for small and medium-sized businesses

The event also featured a panel discussion on how PCG works to expand financial inclusion for small businesses at the Sloan Small Business Campus at 10 p.m.

Panelists included PCG experts including:

Stacey Manvitz, Vice Chair and Co-Chair of the Shared Interests Committee Credit Risk Committee

Alex Area, Chief Investment Officer, African Development Bank AFAWA

Lusanda Neshtenze, TUHF21 CEO

Dorcas Onyango, Shared Interest Global Program Director and PCG Convening Architect

Joyce Masi, Kwheza Managing Director and Malawi Shared Interest Implementing Partner

The event attracted participation from banks, microfinance institutions, and stakeholders from the SME empowerment ecosystem.

“Partial credit guarantees play a catalytic role in closing the risk gap.

This will allow financial institutions to extend credit to small and medium-sized enterprises considered too risky, especially women-led businesses, while maintaining the quality of their portfolios,” Elia said.

“They are one of the most effective tools for expanding financial inclusion and building a fairer economy.”

Since 1994, Shared Interest has worked to advance inclusive development for traditionally disadvantaged communities in southern Africa by developing opportunities that were previously unreachable.

“In Cape Town, real estate developers and homeowners have access to funding to develop affordable housing for working people, creating jobs and helping rebuild communities,” says Manvitz.