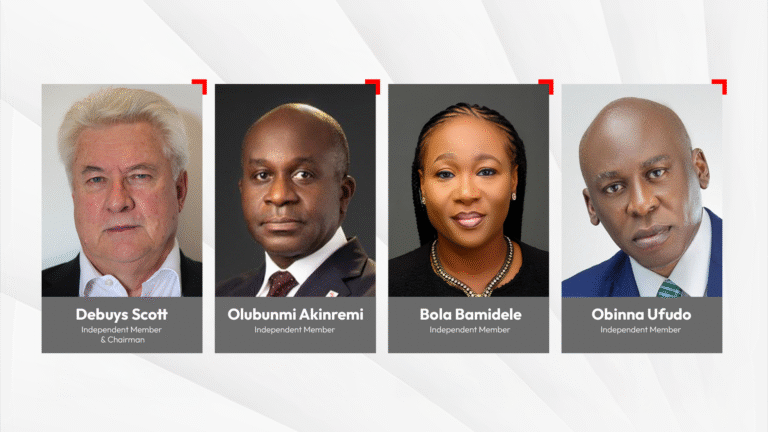

United Capital Infrastructure Fund Investment Committee Member

To reposition infrastructure opportunities in Nigeria and across Africa, United Capital’s Board of Directors announced the appointment of four experienced infrastructure investment professionals as independent members of the Investment Committee of United Capital Infrastructure Fund (UCIF). With investments in power, industrial recycling, and renewable energy, UCIF continues to deliver strong results, achieving a year-to-date total return of 24.62%. The appointment was confirmed subject to approval and clearance by the Securities and Exchange Commission.

Commenting on the announcement, Peter Ashed, Group Chief Executive Officer of United Capital, said: “These appointments have been made to further deepen the Fund’s governance and ensure that UCIF continues to drive sustainable impact through its investments. I welcome the newly appointed members of the Investment Committee and task them with ensuring sustainable growth and impact, while delivering consistent value to investors.”

The appointees bring fresh perspectives, multilateral experience, and decades of multi-sector experience across infrastructure and investment. The appointees are:

David Scott is appointed chairman. Other independent members include Olubunmi Akinremi, Bola Bamidele and Obinna Uhud. They join other members of the investment committee such as Odili Ogini, Uchenna Mukpal and Adeyinka Jafojo. Mr. Samuel Nwanze resigned from the Investment Committee upon the expiration of his term. United Capital Group would like to express our deep gratitude to Samuel Nwanze for his insight and contributions to our rigorous investment process during his tenure.

Also commenting on the announcement, UCIF’s Chief Investment Officer and Fund Manager, Uchenna Makpal, said: “We are pleased to welcome our new members to the Investment Committee and look forward to relying on their proven track record, extensive multi-jurisdictional experience and impeccable professional reputation to guide UCIF’s strategic direction as we expand competitively profitable investments in Nigeria and across Africa.”

Investment committee member profile

de Buys Scott – Independent Member and Chairman

De Buys is a managing partner at Cornerstone Infrastructure Advisors and a former senior infrastructure partner at KPMG (South Africa). He is a qualified Chartered Accountant and has extensive African and international experience specializing in Public Private Partnerships (PPP). Corporate finance and project finance. We raise capital in a variety of sectors, including transportation, passenger rail, healthcare, and mixed-use real estate.

Olubunmi Akiremi – Independent Member

Bunmi is the CEO of Tocam Capital, a project development company focused on natural resources and related infrastructure. He has over 30 years of experience in investment banking and corporate finance in Nigeria, the US and the UK, and has raised over $5 billion in the Nigerian market. He has served as a senior special advisor to the past two Nigerian presidents on economic policy and has held non-executive director and audit committee roles in companies in the financial services and real estate sectors. He holds a BA in Economics from the University of Essex, an MBA from Cranfield University and is an Associate of the Institute of Chartered Accountants in England and Wales.

Bhola Bamidele – Independent Member

Before retiring from the World Bank Group after nearly 25 years, Bora served as Sub-Saharan Africa Regional Lead, Transaction Advisory and Equity Mobilization at the International Finance Corporation (IFC). Bora has experience launching and building impact investments and has worked in sub-Saharan Africa, Latin America, Asia and Europe. She is also skilled in international business, M&A advisory, infrastructure, structured and project finance.

Obinna Uhud – Independent Member of Parliament

Obinna is an experienced director and executive with more than 30 years of experience spanning banking, investments, infrastructure, energy and social impact. He is Chairman of Loanbook Limited and Atiat Limited and a non-executive director of Abbey Mortgage Bank. Previously, he served as President and Group CEO of Transnational Corporation of Nigeria Plc (Transcorp), where he led a successful turnaround that delivered over US$1 billion in shareholder value within three years. He is the Founder and Chairman of the Sir Pius Uhud Foundation, a Fellow of CIBN, a British Chevening Scholar, a Wharton AMP alumnus, and an IESE Executive MBA.

About United Capital Infrastructure Fund (UCIF)

The United Capital Infrastructure Fund (UCIF) is an SEC-authorized $150 billion closed-end fund designed to finance and support infrastructure and related projects in Nigeria and sub-Saharan Africa. The fund targets key sectors including agribusiness, industrial recycling, renewable energy, gas infrastructure, healthcare and manufacturing. UCIF is committed to providing competitive returns to investors while funding high-impact, sustainable projects that contribute to economic growth and development.